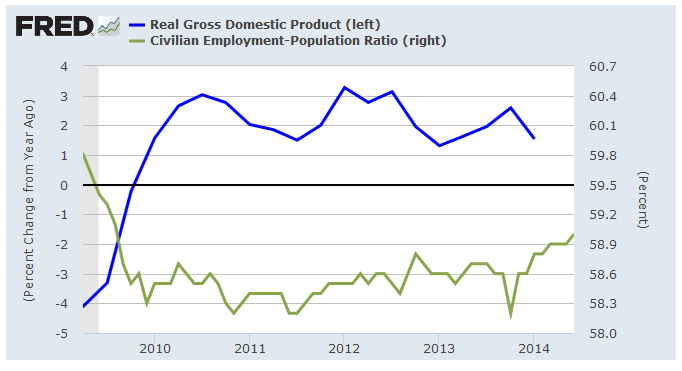

While coming into the second half of 2014 we just had the GDP and employment rpts, and what happened is we got what seemed to be contradictory -2.7% and +6.3 bombshells. On the other hand (Truman hated economists saying that) a look at the year over year GDP return along with the employment/population ratio puts the two together.

[click to enlarge]

The reason GDP growth looks solid is because that -2.7% was just one Qtr to the next, so last week's rpt tells us more about how good Q4 was than it does about how bad Q1 turned out. Something else is the fact that over this past 1/2 year employment/population is finally making a move --a move we've not seen since the "recovery" began in '09.

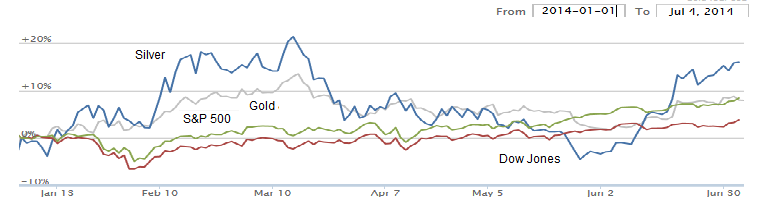

OK, so last week I said "IMHO we're in an economy where we can still make money but it's just going to take more effort", but judging how stocks'n'metals are now rising up from this year's base there's reason to think that it may not take as much effort after all...