Investment & Finance End of 2014 Q3 into Q4 Thread Edition

| Comodities | Stock Indexes | ||||||

| now | 3 Mo. Chg. | Annualized return | now | 3 Mo. Chg. | Annualized return | ||

| gold | $1,220.26 | -7.2% | -25.9% | S&P500 | 1,982.85 | 1.2% | 4.7% |

| silver | $17.71 | -16.2% | -50.7% | DJIA | 17,113.15 | 1.7% | 7.0% |

| oil | $512.66 | -6.2% | -22.6% | NASDAQ | 4,512.19 | 2.4% | 9.8% |

| U.S. $ | $85.62 | 6.7% | 29.8% | Rus2k | 1,119.33 | -6.2% | -22.5% |

Looks like the dollar soared (so much for Fed printer devaluations), metals tanked (so much for safe havens), and while big cap. stocks have done best this past quarter the current status is "market under pressure" (read: under a cloud)

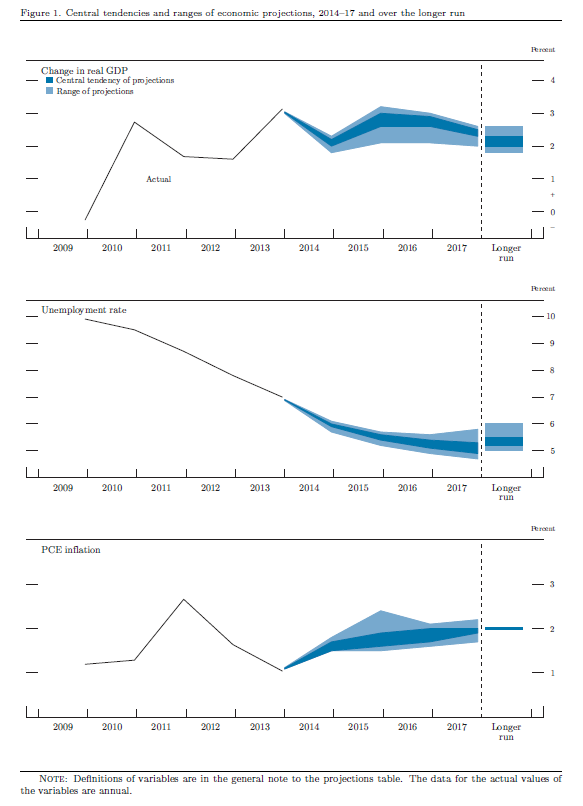

OK so while the future is anyone's guess we do know that these plotted guesstimates are what the Fed (FOMC) is planning on

---[click/enlarge]>>

The new-quarter homework reading assignment. Note: this material will be on the Final Exam:

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |